Laxmi Dental Care, a leading name in the dental solutions industry, is making headlines with its Initial Public Offering (IPO). Renowned for its innovative dental products and services, the company has consistently demonstrated strong growth. As the healthcare sector rapidly expands, Laxmi Dental’s IPO presents an exciting and promising opportunity for potential investors.

Company Overview

Laxmi Dental Care is India’s only end-to-end integrated dental products company as of September 30, 2024 (Source: F&S Report, page 288). It offers a comprehensive portfolio, including:

- Custom-made crowns and bridges

- Branded dental products like aligner solutions, clear aligners, thermoforming sheets, and related products

- Pediatric dental products

With over 20 years of legacy, the company ranks among the top two largest Indian dental laboratories based on revenue for Fiscal 2024 (F&S Report).

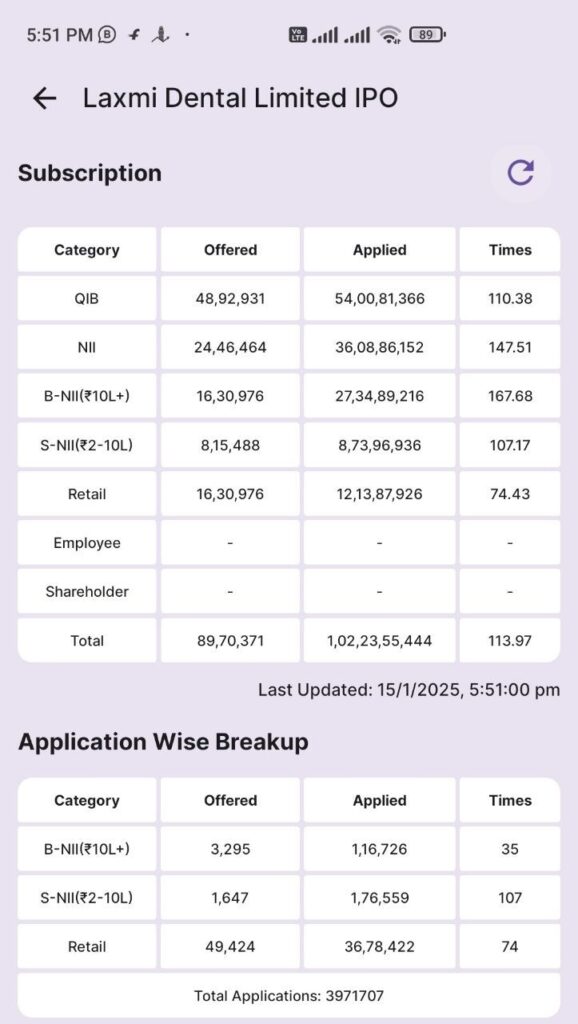

IPO Details

The IPO aims to raise capital for expanding production capacity, research and development, and strengthening distribution networks.

Key Details:

- Issue Size: 1,63,09,766 Shares (Approx. ₹698.06 Cr)

- Fresh Issue: 32,24,299 Shares (Approx. ₹138 Cr)

- Book Building: 1,30,85,467 Shares (Approx. ₹560.06 Cr)

- Price Band: ₹407 to ₹428

- Lot Size: 33 Equity Shares and multiples thereof

- Listing Exchanges: NSE, BSE

- Dates:

- Opening Date: January 13, 2025

- Closing Date: January 15, 2025

Objectives of the IPO

- Debt Reduction: Proceeds will reduce existing debt, improving financial health.

- Expansion of Operations: Funds will support capital expenditure for new machinery, meeting growing demand.

- Debt Management in Subsidiaries: A portion will go toward repaying/prepaying liabilities in subsidiaries.

- Investment in Subsidiary: Capital expenditure in its subsidiary, Bizdent Devices Pvt. Ltd., will be prioritized.

- General Corporate Purposes: To cover miscellaneous corporate expenses.

Financial Performance

Laxmi Dental has shown consistent growth in revenue and profitability over the past few years.

Key Financial Metrics:

- Revenue Growth: 11.51% (2023); 10.83% (2024)

- Net Profit: ₹-4.44 Cr (2022); ₹1.42 Cr (2023); ₹22.71 Cr (2024)

- Debt-to-Equity Ratio: 0.94

- Return on Equity (ROE): 78.78%

Know more: https://groww.in/blog/laxmi-dental-ipo-allotment-status

Industry Outlook

The global dental care market is growing at a 7% CAGR, driven by:

- Rising awareness of oral health

- An aging population

- Advancements in dental technology

In India, the market is growing even faster, with a 13% CAGR, thanks to rising healthcare spending and a growing middle class.

Strengths

Laxmi Dental Care offers several advantages:

- The only integrated dental products company in India, well-positioned for industry growth.

- The second-largest player in the domestic laboratory business and the largest export laboratory, benefiting from digital dentistry.

- Vertically integrated, diverse branded product portfolio.

- A large dental network that provides a competitive edge.

Risks and Considerations

Potential investors should be aware of these risks:

- Limited Fresh Issue: Only about 20% of the funds raised will be directly invested in the company.

- Legal Cases: Existing legal disputes involving the company and its promoters could pose risks.

- Talent Acquisition Challenges: Success depends heavily on skilled technicians and a strong dental network. A shortage of talent could impact growth.

- Low Promoter Holding:

- Pre-IPO promoter holding: 18.34%

- Post-IPO promoter holding: 16.91%

This could indicate reduced promoter confidence.

Conclusion

The Laxmi Dental IPO offers an exciting opportunity to invest in the growing dental care market. With its strong market position, improving financial performance, and ambitious growth plans, the company has the potential to deliver significant returns.

However, as with any investment, it’s essential to understand the associated risks and conduct due diligence.

Stay tuned for more updates on the IPO. If you’re considering investing, consult a financial advisor to ensure it aligns with your investment goals.

To be up to date with business in the dental sector please view this: https://flossdaily.in/category/business